Let’s be honest. If you own a gas-powered car right now, there’s probably a low-level unease you can’t quite shake. You’re standing at the pump, watching the price climb, when a silent electric car slides past like it already belongs to another decade. Suddenly, the mechanical complexity of your own engine feels a bit… heavy.

At some point, the questions inevitably creep in: Is my car quietly becoming obsolete? Am I holding an asset that’s about to lose real value? Should I be thinking about selling before everyone else does?

These aren’t dramatic thoughts. They’re practical ones. I’ve spent over 15 years working around vehicles and logistics, and I can say this with confidence: the industry has never felt quite like this before. Not since the shift from horses to internal combustion engines has the roadmap been so blurred. It feels chaotic. And when your own money is tied up in a vehicle, that uncertainty hits closer to home.

Still, here’s the part that tends to get lost in the noise. The future isn’t a light switch. There is no sudden moment where gas cars turn into pumpkins at midnight. The transition is real, absolutely, but it’s uneven, slower than advertised, and far more complicated than the tech-vloggers suggest. In fact, for many owners, a gas car may remain one of the more stable assets they have over the next few years.

Let’s look at why.

The Current Vibe: Why Everybody is Nervous

Nervousness in the market stems predominantly from momentum and rapidly changing perception. I’ve seen this movie before. Nearly every major automaker has pledged billions to electrification. Governments are setting ambitious targets to phase out new combustion sales. The stock market worships EV startups and punishes traditional “legacy” automakers deemed too slow to pivot.

A powerful narrative develops: electric is the future, gasoline is the past. In financial markets, perception often becomes reality. Widespread belief in declining asset values can reduce demand, and actual values follow suit.

But here’s the thing: there is a massive gap between the “future narrative” and the grit of reality on the ground. Today, over 90% of vehicles on the road still run on fossil fuels. The infrastructure to support them is immense, established, and most importantly, it works. The infrastructure to replace them? It’s growing, but it’s still in its “awkward teenage phase.” The anxiety stems from applying a 2035 vision to a 2025 reality, leading to misalignment.

The “Cliff Edge” Myth vs. The Gentle Slope

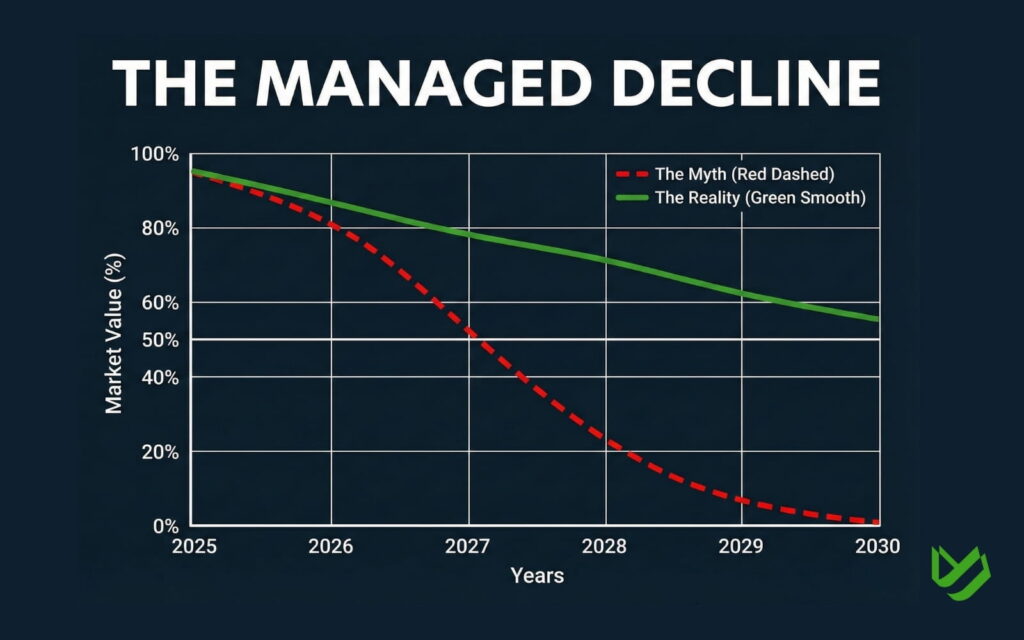

The biggest fear I see among my clients is the “Cliff Edge” scenario, the idea that a sudden tipping point will cause the value of every gas car to crash violently. Experts almost universally agree this is highly unlikely over the next five years.

Automotive markets are huge and lethargic, like the ocean liners we at Compare the Carrier occasionally help transport. They don’t turn on a dime. There are hundreds of millions of gas cars currently in operation, forming the backbone of daily life. As long as these cars provide reliable, convenient utility, they will hold value. Period.

The more probable scenario is a “managed decline.” Instead of a crash, we will likely see the depreciation rate for generic gas cars accelerate slightly. Normally, a car loses value the moment you drive it off the lot. In the next five years, that downward curve might get a little steeper for average vehicles because the buyer pool for secondhand gas cars will slowly start to shrink as more people opt for used EVs.

The Reality Check: What’s Keeping Gas Car Values Up?

Despite a future that appears electric, current gas car values remain supported by several factors. From a buyer’s perspective, multiple ‘handbrakes’ on the EV transition make gas vehicles essential for the foreseeable future.

Not All Gas Cars Are Created Equal

This point is crucial: ‘gas cars’ should not be treated as one homogeneous group. The market is splintering.

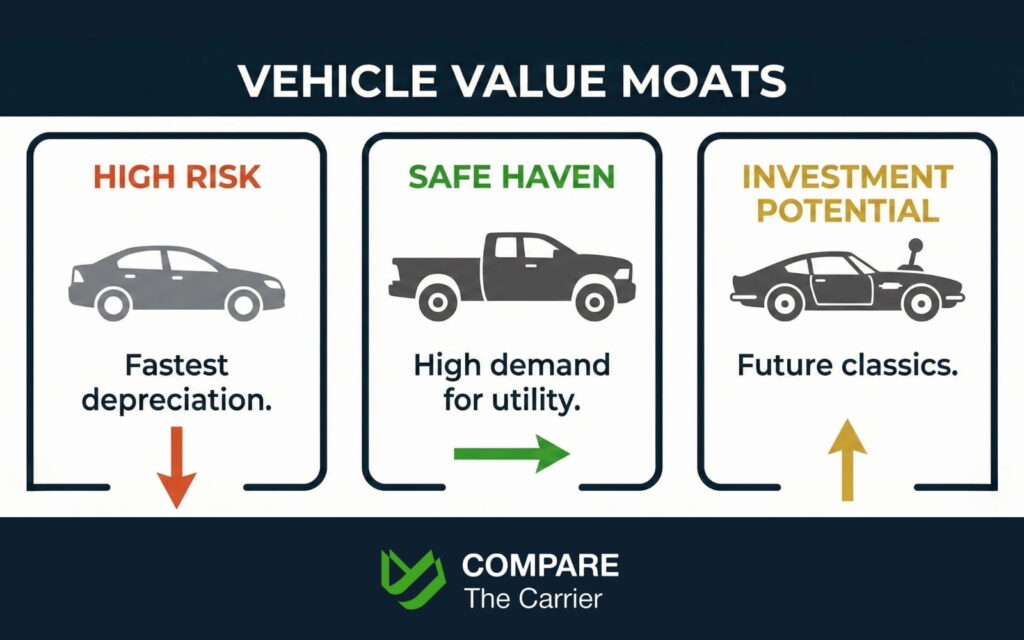

The Appliance Car (The Vulnerable Middle)

If you drive a generic, mid-sized sedan or compact crossover, this is the segment most vulnerable. The Model 3, the Bolt, and electric Kias are all aiming for this crowd. This is where you might see the top car shipping companies moving more EVs in the coming years.

The Workhorses (Trucks and Large SUVs)

These vehicles have a moat around their value. They are bought for capability towing, hauling, and road trips without charging hassles. Because these are high-value assets, I’ve seen owners increasingly invest in professional door-to-door car transport to move them to regions where demand (and price) remains highest.

The Enthusiast and Niche Vehicles

Here is the twist: electrification might make certain gas cars more valuable. Think about sports cars with manual transmissions or powerful V8s. As automakers stop producing these visceral machines, the existing ones become finite commodities.

The 5-Year Forecast: A Year-by-Year Breakdown

What does this mean for you? Here is the likely roadmap:

Conclusion

So, should you be worried? Awareness is smart, but panic is unnecessary. Over the next five years, expect your gas car to remain useful and tradable. The shift away from internal combustion engines will be slow and steady, not abrupt. Plan based on your needs and the likely, gradual decline not a sudden loss in value.

My best advice? Don’t try to time the market based on fear. Buy the car that makes sense for your life today. If you find yourself needing to move a high-value gas vehicle to a buyer in another state to maximize your return, ensure you use professional transport to keep that asset protected. The future is electric, but the present is still very much a mixed road.

Would you like me to analyze the resale outlook for your specific make and model to see how it fits within this 5-year window?

FAQ

Should I sell my gas car right now?

Deciding to sell a gasoline vehicle should be based on individual utility rather than market panic. For most owners, keeping a reliable internal combustion engine (ICE) vehicle still is a sound financial decision in 2026. While depreciation is inevitable, well-maintained gas cars continue to provide high utility within areas with developing charging infrastructure, preventing a total loss in resale value over the next five years.

Will gas stations start disappearing anytime soon?

Gas station infrastructure will continue strong for decades due to the 280 million gasoline-powered vehicles currently on U.S. roads. While some urban stations may integrate EV charging hubs, the vast majority will continue traditional operations to serve the existing global fleet. No profitable fuel network can quickly abandon the massive user base that relies on internal combustion engines for daily transportation.

Are used EVs a serious threat to gas car values?

The used EV market is expanding but does not yet pose a catastrophic threat to gas car resale values. As of 2026, consumer concern about battery condition and repair costs remains high, with many buyers preferring the predictability of traditional engines. This skepticism sustains the demand for used gas vehicles, which offer established maintenance networks and a more familiar refueling infrastructure compared to used electric alternatives.

How do I safely move a car after a long-distance sale?

High-value vehicle relocation is best managed through professional door-to-door enclosed auto transport. This method protects the car from road debris, weather, and environmental damage, which is critical for preserving the resale value and mechanical integrity of the asset. Utilizing professional logistics providers guarantee that the vehicle is moved in a temperature-regulated environment with specialized security procedures and comprehensive insurance coverage.

Will gas cars become worthless in 5 years?

Gasoline vehicles will not become obsolete or worthless by 2031. While the automotive market is shifting toward electrification, the transition is a gradual process rather than an immediate collapse. Quality ICE models, particularly pickup trucks and SUVs, are projected to sustain steady demand. Resale values will decline through standard depreciation, but a sudden market crash is highly improbable given current global infrastructure restrictions.

How do electric vehicles affect the resale value of gas cars?

The rise of EVs is gradually reducing the demand for new internal combustion engines, but the used-car market stays robust. While high-volume electric models can pressure the prices of compact economy cars, premium and utility-focused gas vehicles maintain considerable liquidity. In 2026, the market is defined by coexistence, where fuel-efficient ICE models remain attractive to buyers prioritizing range and immediate refueling availability.