At Compare The Carrier, we believe in being 100% open and honest, because that’s the only way trust is built. As we head into 2026, machines are getting smarter, and the vehicles we ship are becoming high-tech computers on wheels. The old idea of “it just works” no longer applies to insurance. You need to understand exactly where the carrier’s responsibility starts and where the risk hits your own wallet.

In this guide, we’re going deep. We aren’t just talking about scratches; we’re talking about LIDAR sensors, EV battery integrity, and the legal “gray areas” that many companies try to hide.

Introduction: Understanding Risk in 2026

The intuition that “insurance handles everything” is often on the fritz. A tiny “oops” on paper back in 2010 was no great disaster; by 2026, that same minor sign of a scrape could be a $5,000 headache for a supplemental partnership system.

In real life, many people think that just by throwing money at a transport company, they are fully covered. They see a signature on a screen and think they’re safe. But let’s be real: if you aren’t serious about the fine print, you are gambling. When you first drop a car or take on a role as a collector, getting into the world of motoring logistics is a big deal. You need a partner who knows the difference between “legal minimum” and “total protection.”

The Legal Framework: FMCSA, DOT, and the Bare Minimum

To figure out what’s involved in your protection, we need to look at who sets the guidelines. The Federal Motor Carrier Safety Administration (FMCSA) and the Department of Transportation (DOT) are the legal overseers of motor vehicle licensing and insurance.

The Requirements of the MCS-90

Every truck that hauls cars for hire must have a special MCS-90 permit. This is essentially the carrier’s “license to drive” in the commercial world. But here’s a trap that many people don’t notice: the MCS-90 is primarily for public liability. It ensures the carrier can pay if they hit a bridge or cause a highway pileup. It doesn’t actually guarantee that your specific car is covered for a scratch.

In real-world travel, a professional group like Compare The Carrier acts as your first piece of evidence. We verify that our carriers don’t just have the MCS-90, but also have robust “Cargo Insurance” that specifically covers the vehicles on their trailer.

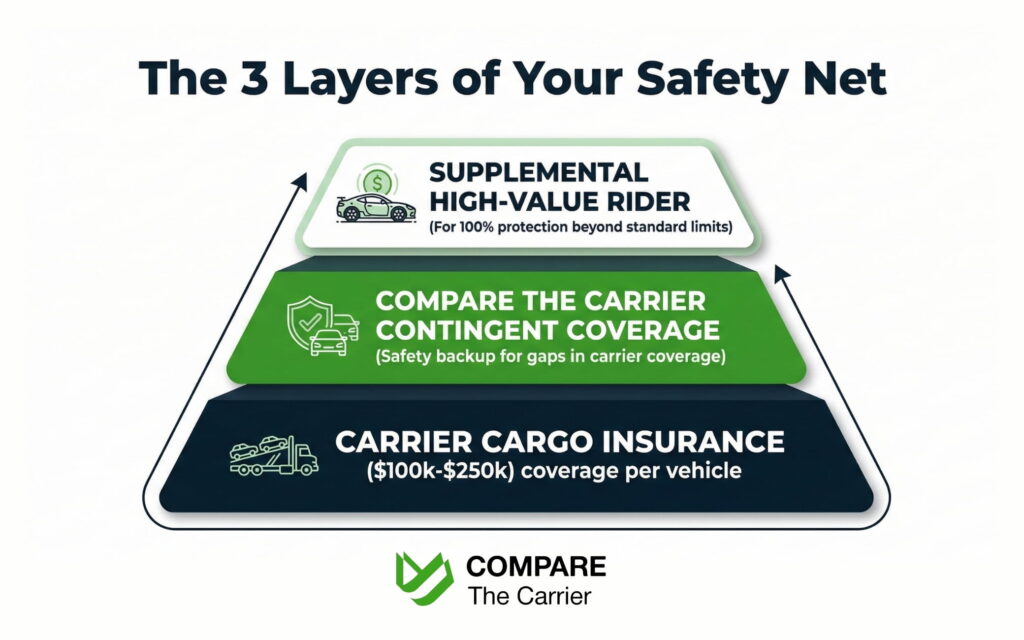

Three Tiers of Coverage: From the Starting Point to Full Security

Not all security is created equal. Depending on your budget and the value of your vehicle, you generally have three levels of protection to choose from.

1. Carrier Cargo Insurance (The Strategist)

This is your standard “baseline” cover. Almost every professional carrier has cargo insurance ranging from $100,000 to $250,000.

In practice, this sounds like a lot of money. However, from my point of view, you have to do the math. If a carrier is hauling nine luxury SUVs worth $80,000 each, a $250,000 policy is a disaster waiting to happen. If the truck rolls over, the insurance won’t even cover half the load. This is why we vet carriers to ensure their limits match the load they are carrying.

2. Broker “Contingent” Cargo Insurance

At Compare The Carrier, we maintain “Contingent Cargo Insurance.” This is your safety net. If a carrier’s primary insurance is denied because they forgot to pay a premium or violated a minor policy rule, our contingent insurance kicks in. From where I’m sitting, this is the single most important reason to work with a reputable broker rather than a “hotshot” driver found on a random message board.

3. Supplemental or “High-Value” Insurance

For high-value assets classic Ferraris, limited-edition EVs, or atypical custom builds having standard cargo mode simply doesn’t cut it. If your car costs more than $150,000, do not just ship it with a standard policy.

In these cases, we recommend a “rider” or supplemental policy. This covers the “gap” between the carrier’s limit and your car’s actual replacement value. In real-world scenarios, it’s worth paying a bit more for a zero-deductible supplemental policy than risking a $30,000 loss on a technicality.

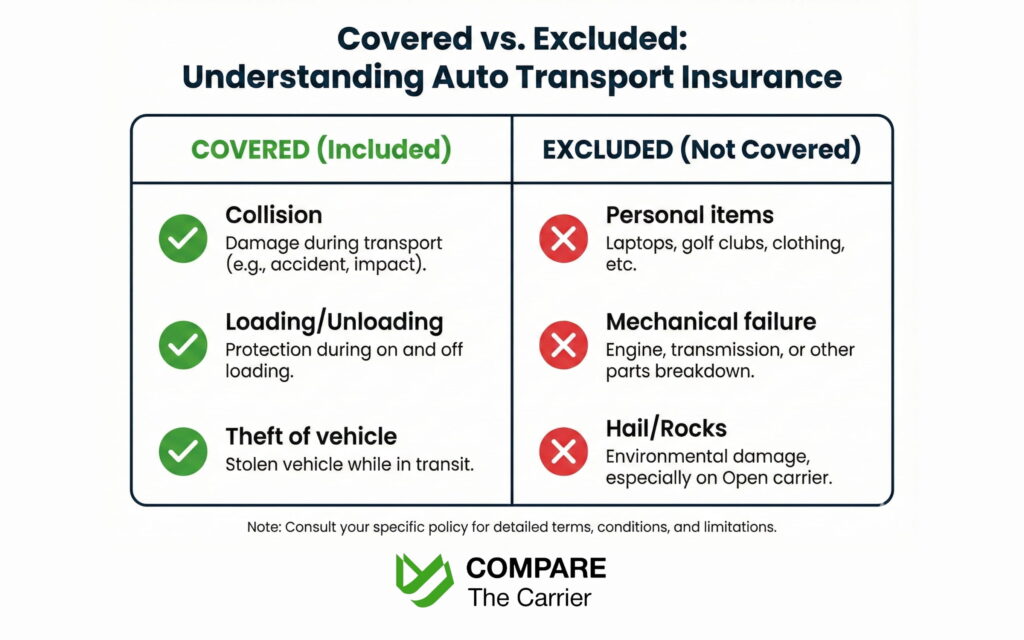

What Is Covered: Common Sense Scenarios

When people ask about the past and what they are paying for, cargo insurance really shines in comparison to these specific situations.

Physical Damage During Loading and Unloading

Statistics show that the vast majority of transport “mishaps” happen within the first or last 50 feet of the journey. A car slipping on a wet ramp or a driver misjudging the height of the top deck are the most common claims.

In the real world, if a driver causes damage to your car while pulling it onto the trailer, this is a clear-cut insurance claim. At Compare The Carrier, we emphasize that our partner carriers are trained to minimize these incidents, but if they do occur, our cargo policy is adjusted to deal with the situation.

Theft from Terminals or Parking Lots

If the truck is stolen from a stop or your car is taken from a carrier’s yard, you are all set. While theft is rare in the professional door-to-door car transport world, the insurance is there to protect you against “total loss.”

The “Gotchas”: What Is NOT Covered?

This is a key part of our operations. Understanding what isn’t covered separates the “ready” team from the “surprised” one. Insurance companies are not in the business of giving money away, so they have strict exclusions.

1. Personal Items

Let’s be realistic: everyone wants to save a little by packing a few extra boxes in their trunk. From a practitioner’s perspective, this is a terrible idea.

Carrier insurance focuses on the vehicle, not individual freedoms. If you leave a $2,000 MacBook or a set of $3,000 golf clubs in the car and they are stolen or damaged, you will get zero compensation. Even worse, if your personal items aren’t secured and they fly around inside the cabin when the truck turns, they could destroy your upholstery or break a window. In that case, the insurance will deny the claim for the window too, because the damage was caused by “unauthorized household goods.”

2. Mechanical and Electronic Issues

Car insurance covers the exterior of the car. If the transmission starts making weird noises or the Tesla’s infotainment system goes dark, the insurance company will safely deny the claim.

Whether they are organized or not, adjusters will argue that these are “inherent mechanical failures” that were not caused by the movement of the truck. Unless you can prove the driver crashed into something that caused the mechanical failure, you’re on your own for internal repairs.

3. Acts of God (The “Open Carrier” Risk)

This is a major consideration heading into the 2026 market. If you choose an open trailer to save money on your car shipping cost calculator, you are accepting weather risk.

If you are shipping through the Midwest during storm season, for the love of your car, choose enclosed transport.

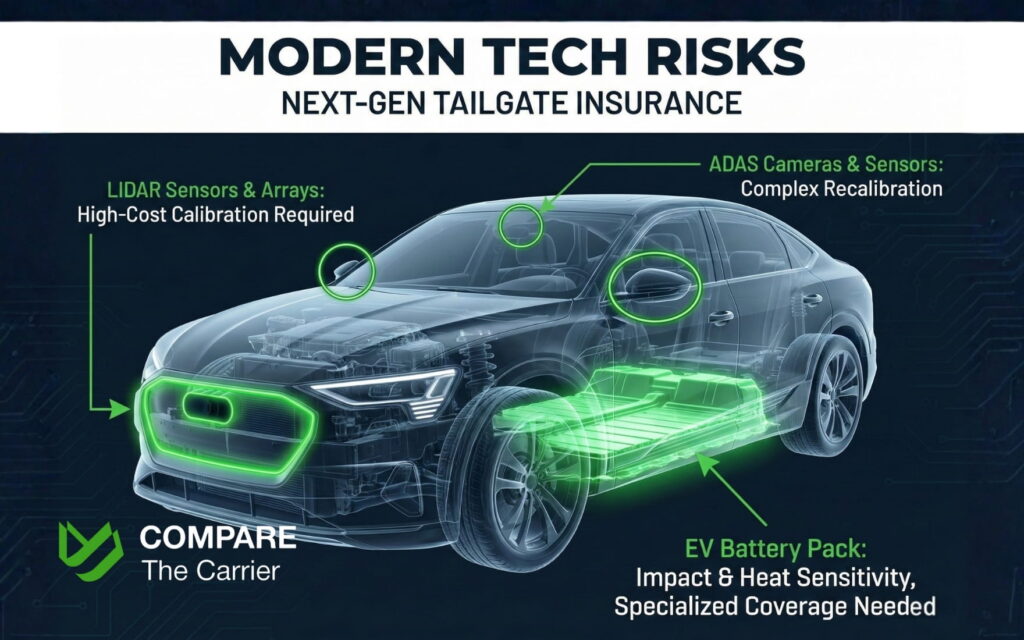

2026: Next-Gen Tailgate Insurance

The closer we get to 2026, the more complex transportation becomes. Vehicles are no longer just metal; they are sensor arrays.

ADAS Relapse Protocol

Today’s cars are loaded with sensitive tech. A minor nudge on the bumper that doesn’t even leave a dent can misalign a LIDAR sensor or a camera. It’s worth noting that many traditional insurance routes are struggling to keep up with this. You need a transporter that isn’t “damage agnostic.” You need someone who knows that “if it looks fine, it might not be fine.”

EV Battery Integrity

The electric chassis is quite heavy, and the weight is all in the battery pack underneath. In real life, if the carrier uses the wrong tie-down points, they can damage the battery casing. This is why we work with specific drivers who have the certifications to handle EVs correctly.

Salvage and Auction Logistics: Copart & IAAI

Can you ship a contract car from a company like Copart or IAAI? Absolutely. But the insurance rules are much tighter.

Most carriers will only insure a salvage car for “Total Loss.” They will not bother with new scratches because the car is already damaged. With a “roller” you are primarily paying for the logistics, not the cosmetic protection

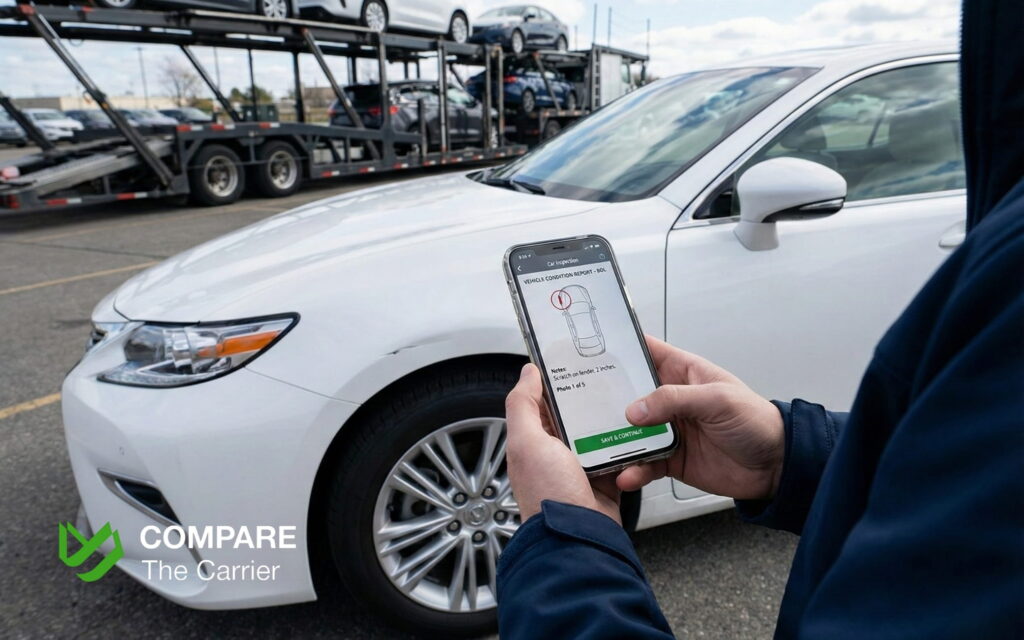

Shipping: A Practical Guide to Verifying Protection

How do you tell if a carrier is honest?

Step-by-Step: Filing a Successful Claim

If you are hit by a storm or an accident and your car is damaged, don’t panic. Follow these steps:

Conclusion

At the end of the day, motoring is all about the little things. The 2026 strategy is simple: trust but verify, optimize for protection by using enclosed transport for high-value assets, and document everything on the Bill of Lading.

At Compare The Carrier, we take the guesswork out of the loop. We only do business with carriers we can count on.

Would you like to see how we can protect your specific vehicle?

Use our car shipping cost calculator today to get a quote that includes comprehensive protection for your peace of mind.

FAQ

Is my personal car insurance enough to cover my car during transport?

In most cases, no. Your personal policy is for you driving on the road. Most policies explicitly exclude “commercial transport.” The carrier’s cargo insurance is intended as the primary coverage for any damage that occurs while they have the keys.

What happens if I find damage after the driver has already left?

This is a very difficult situation. Once you sign the Bill of Lading as “clear,” you’ve legally said the car is perfect. You can still try to file a claim, but the insurance company will almost certainly deny it. Always inspect the car with a flashlight before the driver leaves!

Does insurance cover the car’s electronics if there is no physical damage?

Usually, no. Standard insurance is for “physical impact.” If a sensor fails or the software glitches without a dent or a scrape to prove it was hit, adjusters will call it a “mechanical failure.”

What is “Gap” or Supplemental Insurance, and do I need it?

Supplemental insurance covers the “gap” between what the carrier’s policy pays and what your car is actually worth. If you are shipping a luxury car worth over $150,000, you should consider it.

Why aren’t my personal items covered by the transport insurance?

Car carriers are licensed to move cars, not furniture. Their insurance doesn’t cover anything inside the car. If you leave your luggage inside, you do so at your own risk.

How can I tell if a carrier’s insurance certificate is fake?

The easiest way is to use the FMCSA SAFER system. Enter the carrier’s DOT number and check the “Licensing & Insurance” section. Never rely on a printed paper; always check the live federal database.